The UK may be perilously close to a recession, businesses may be closing and the city may be deep in the doldrums, but there is one segment of the finance industry that’s still booming. No matter the economic headwinds, the Bank of Mum and Dad seems to do booming business nonetheless.

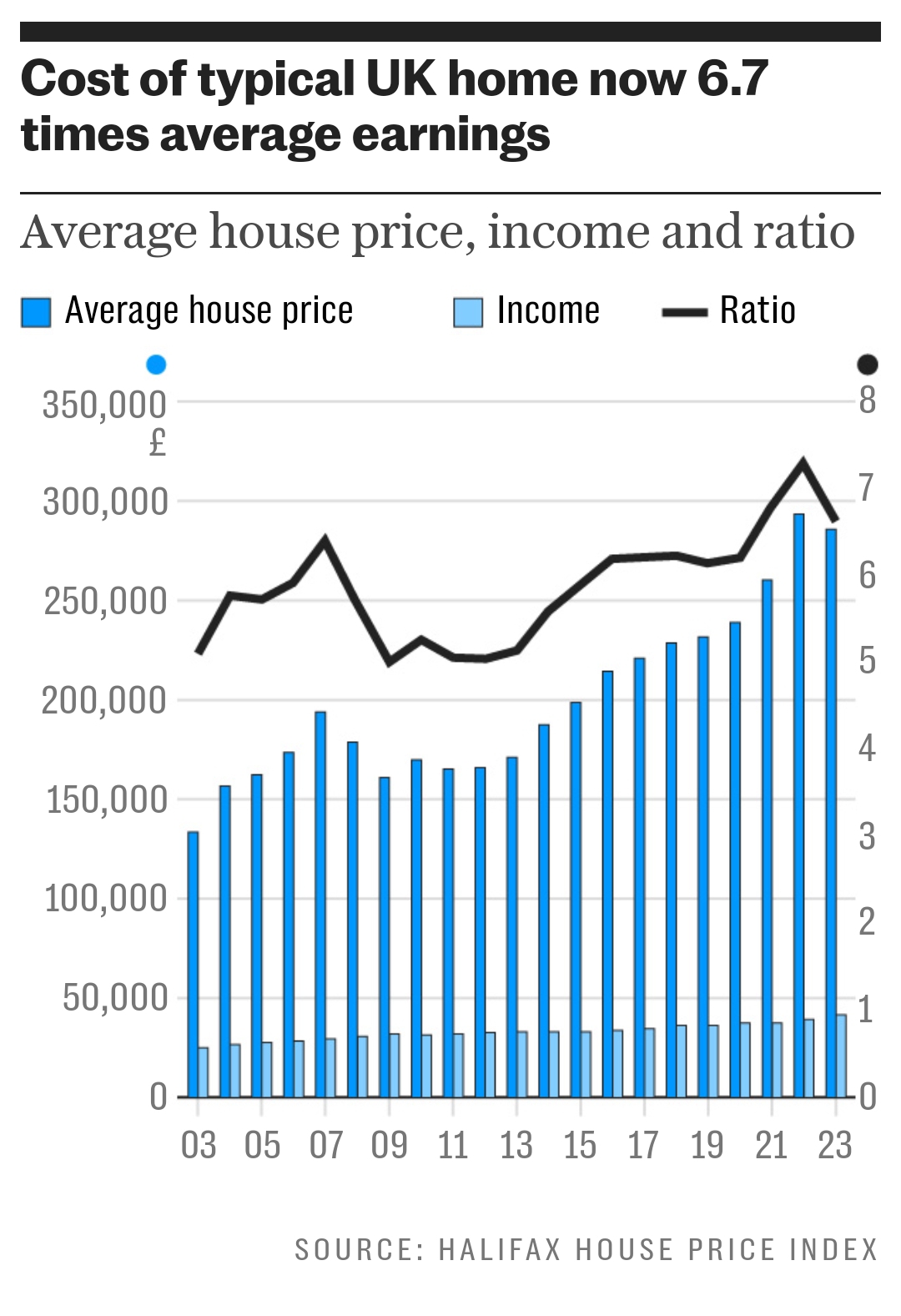

According to statistics released this week, relatives are funding a higher proportion of property purchases than ever before. This year, the total amount of such lending is expected to reach £8bn, and then grow again to £10bn by 2025. At this rate, I wouldn’t blink if it reached £20bn or more by the end of the decade.

But while it’s easy enough to understand why parents want to help their children, the increasing importance of the familial hand-out is contributing to huge divides in society, draining retirement resources and helping to further tie up capital that could be used more productively.

The Bank of Mum and Dad, and the housing market that gives rise to it, is becoming a huge drag on the economy. The only way we can fix this is by finally summoning up the political will to build more houses.

Parents – and the occasional wealthy aunt or uncle for the very lucky – have been helping to get young people started on the property ladder for generations. Yet until relatively recently, that hand up was seen as something restricted to the wealthy upper-middle classes, not dissimilar to sending children to private schools.

While parental assistance might have been a bit more common than that – between a quarter and a fifth of buyers from 1970 to 2004 had help from their parents – it certainly wasn’t the norm. After all, very few people had a spare £10,000 or so lying around to help a kid or two buy their first home.

Over the last two decades, however, that has changed. Family help to buy has become a completely critical component of the property market, and by extension the wider economy as well.

In 2023, relatives are expected to contribute some £8.1bn to help young people buy properties. That money will help close almost half of all purchases by the under 55s, with total lending up 50pc on 2020 and the average sum given reaching almost £26,000.

Large chunks of the British property market seem now to be dependent on intergenerational transfers to keep moving. Take that away, and things will seize up.

It’s not particularly hard to understand why it’s happening. There’s nothing more natural in the world than wanting to help your children or grandchildren get on in life. It’s usually a force for good, motivating people to build up capital, and look after it sensibly.

And at least it recycles some of the £8.7 trillion the UK has locked up in housing wealth – £7 trillion after mortgage debts – between generations.

Yet we also shouldn’t kid ourselves that there’s anything healthy or natural about an economy that has become utterly dependent on older relatives doling out chunks of money. In fact, there are three big problems with the dominance of the Bank of Mum and Dad.

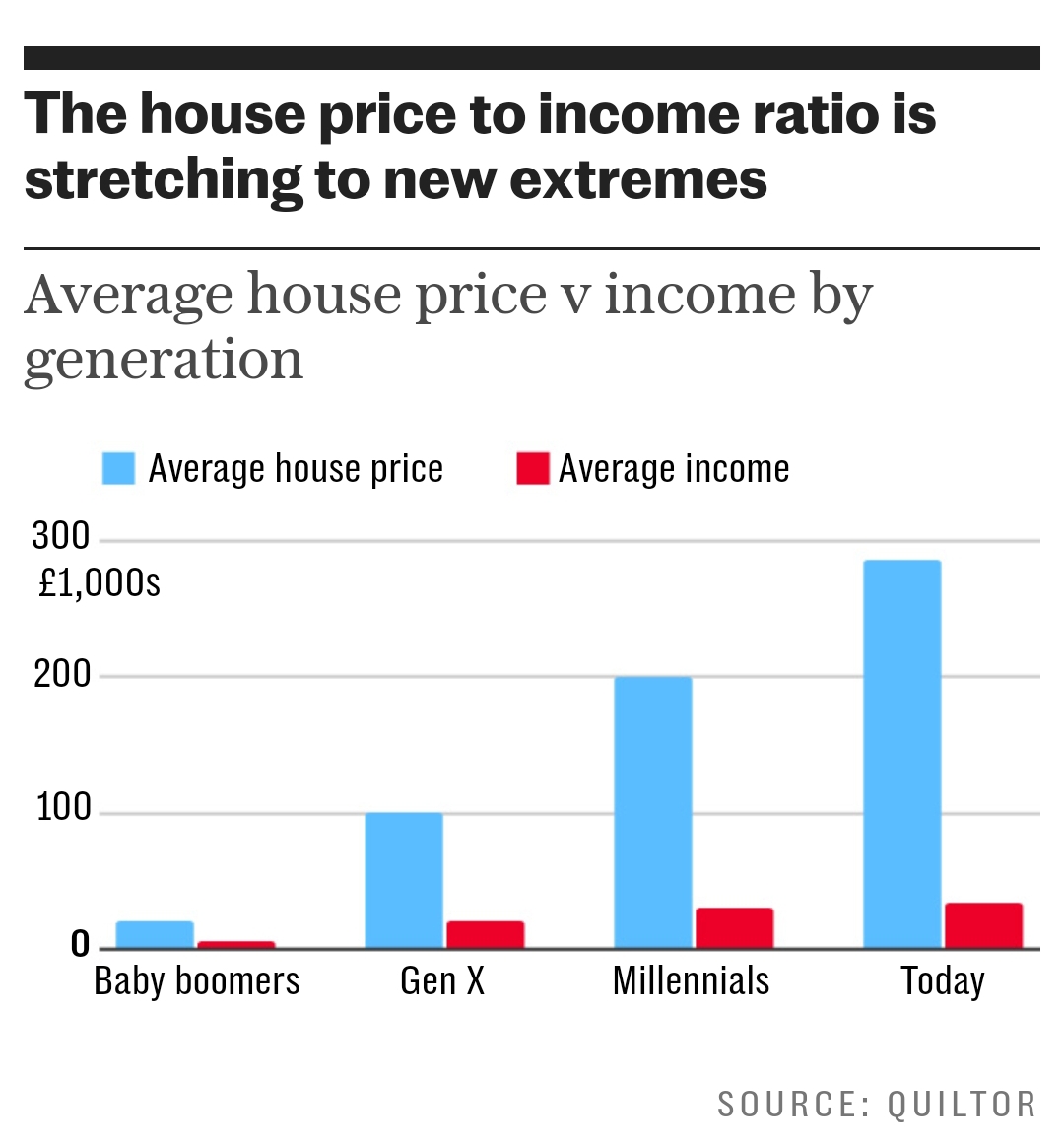

First, it’s contributing to an increasingly wide divide in society between those who can and those who can’t afford to buy property. If one half of the population is getting £26,000 handouts for the deposit on their first home while the other half is not, then huge numbers of people will be finding themselves locked out of homeownership. There is nothing to be celebrated about that.

As Mrs Thatcher quite rightly recognised back in the 1980s, homeownership is not just about having a place to live. It creates a stake in a prosperous, free market economy, it encourages hard work and responsibility and it allows people to build up personal wealth.

Anyone who holds down a steady job should be able to buy a home. If we restrict it to people with well-off grandparents or parents, we will destroy aspiration and ambition.

Next, it drains retirement savings. People are living longer, and medical treatments are getting more and more expensive, while the triple-lock on pensions has become a bigger and bigger strain on the public finances.

And yet at precisely the time when we should be making sure older people can look after themselves financially we are using their money to keep the property market afloat.

Many people look into equity release loans on their own homes in order to help their children buy theirs. In turn, that may well mean having no money left to pay for a care home. It is crazy.

Finally, and perhaps worst of all, it continues the cycle of locking up capital in housing, when we could be directing investment towards the real economy instead.

Just imagine the impact it would have on the British economy if the £8bn going towards buying apartments were directed to entrepreneurs or small businesses looking to scale up their operations? Instead, all we’re doing is keeping house prices artificially high.

The Left will no doubt soon start arguing that we need restrictions on the Bank of Mum and Dad, arguing for controls on gifts, or even more plausibly trying to replace inheritance tax with a levy on any capital transferred from one person to another. All that will do is make the problem even worse.

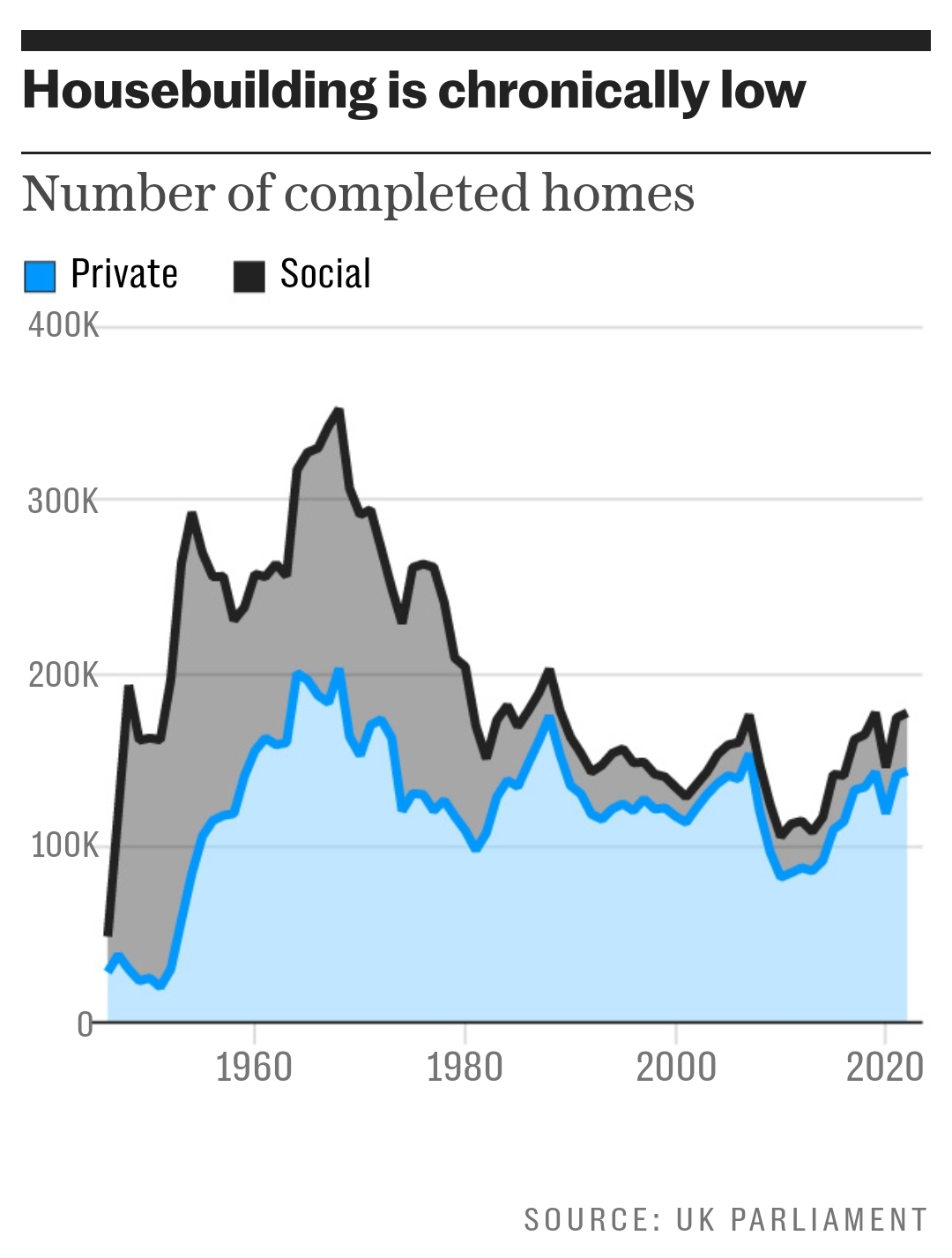

The real issue is the UK’s dysfunctional property market, which has become a huge drag on both the economy and society, and the only fix for that is to finally start to build more homes.

We may well have to start contemplating some genuinely radical changes to make that happen: rethinking the green belt would be a good start, so that we can expand our most productive cities; so would scrapping judicial review for planning to prevent local activists from using the courts to delay projects for years; and mandating local councils to free up a lot more land for development, and to do so a lot more quickly.

However it gets done, until the UK works out how to unblock its planning system and start building more it will be impossible to start growing again – and the Bank of Mum and Dad will keep on getting raided.

Culled from The Telegraph